Optus Digital ID

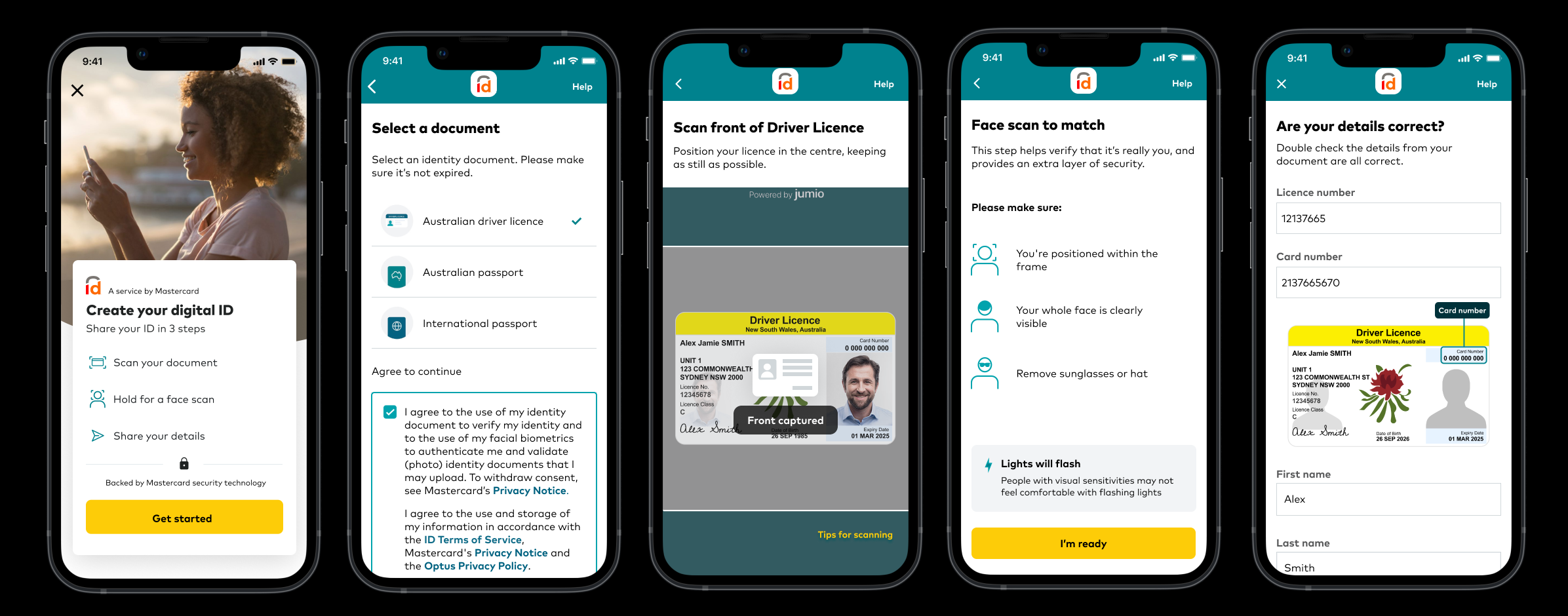

Digital ID, in partnership with MasterCard, was introduced to strengthen customer security and reduce fraud and identity scams. Instead of providing details from two identity documents, which can be vulnerable to misuse, customers could now verify their identity with a face scan matched to a single ID document. Once enrolled, their Digital ID could be securely reused for future verification.

My role and approach

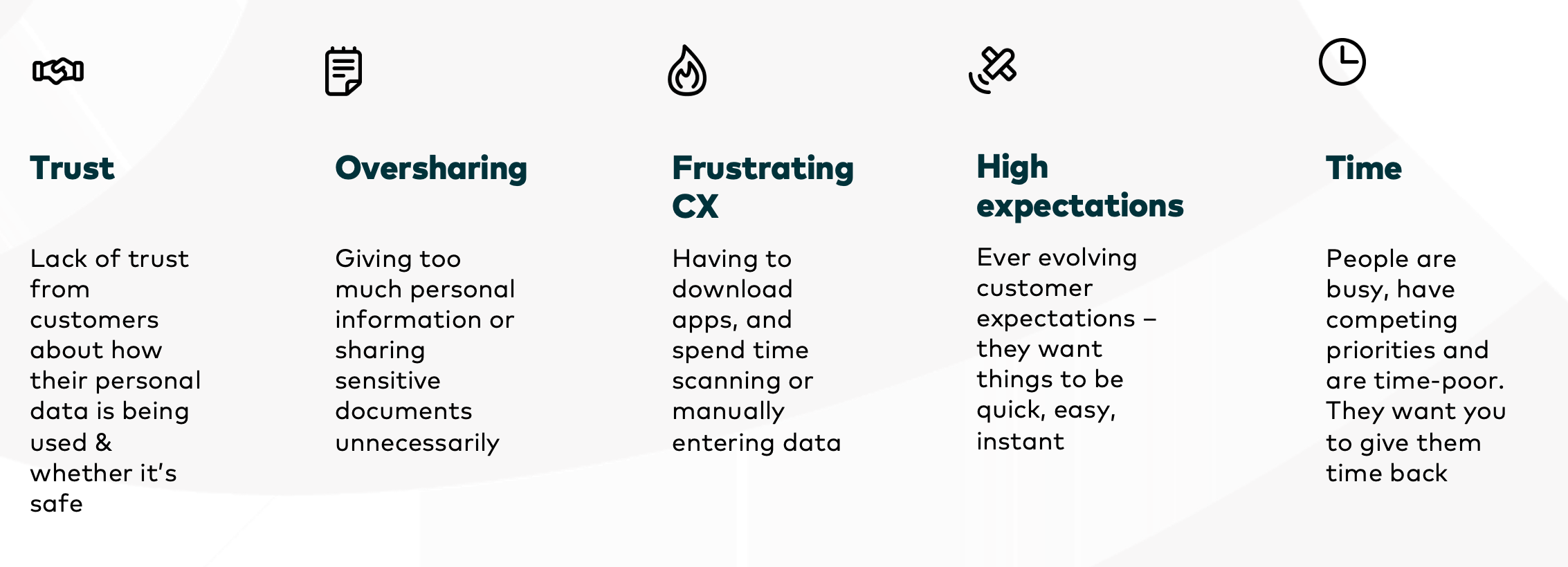

I joined the team after the feature had gone live and conducted several types of research to identify areas for improvement. Since the solution was not only part of the customer experience but also widely used in assisted channels, understanding the agent experience and gathering their insights proved crucial. We ran multiple rounds of usability testing with customers, alongside agent workshops and surveys.

Based on the feedback, we identified and prioritised the key problem areas and made continuous iterations to the interface design and copy as part of agile sprints. The framework was powered by a third-party solution from Jumio, a provider of online payment and ID verification services. Given the technical constraints, it was important to design solutions that worked effectively within these limits.

Design iteration

Although the primary journey was focused on the My Optus app, the feature was also used in retail and contact centres. This made it essential to understand the customer journey and interactions across all channels, as well as to familiarise myself with the platforms used by agents.

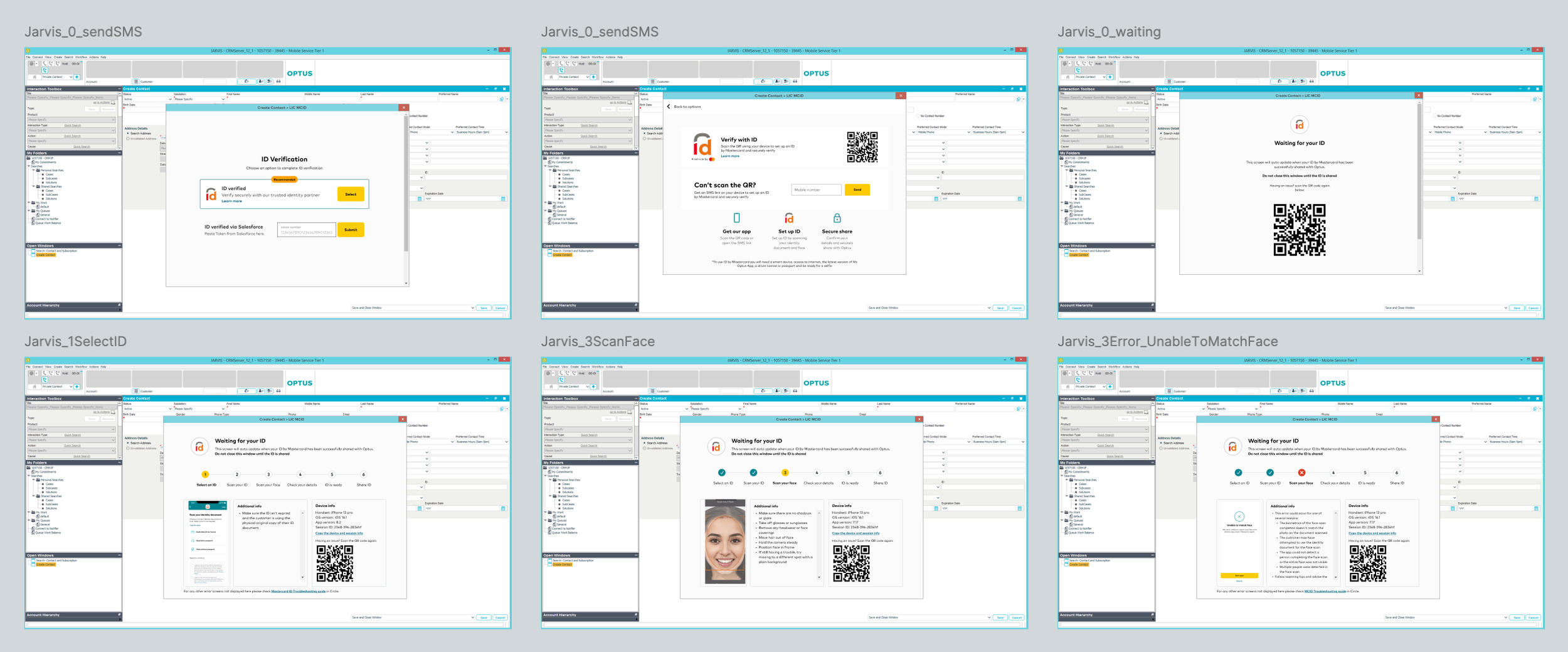

One of the key challenges identified from the agent side was the lack of visibility when customers went through the ID enrolment process during calls or messaging. Without knowing exactly which step or error the customer was facing, agents had to rely solely on the customer’s verbal or written descriptions, making it difficult to provide effective guidance. To address this, we introduced an ‘Agent Visibility’ feature in the CRM, allowing agents to see the exact step and message a customer was encountering, along with troubleshooting instructions. This feature significantly improved enrolment rates, reduced time spent on enrolment, and received highly positive feedback from agents.

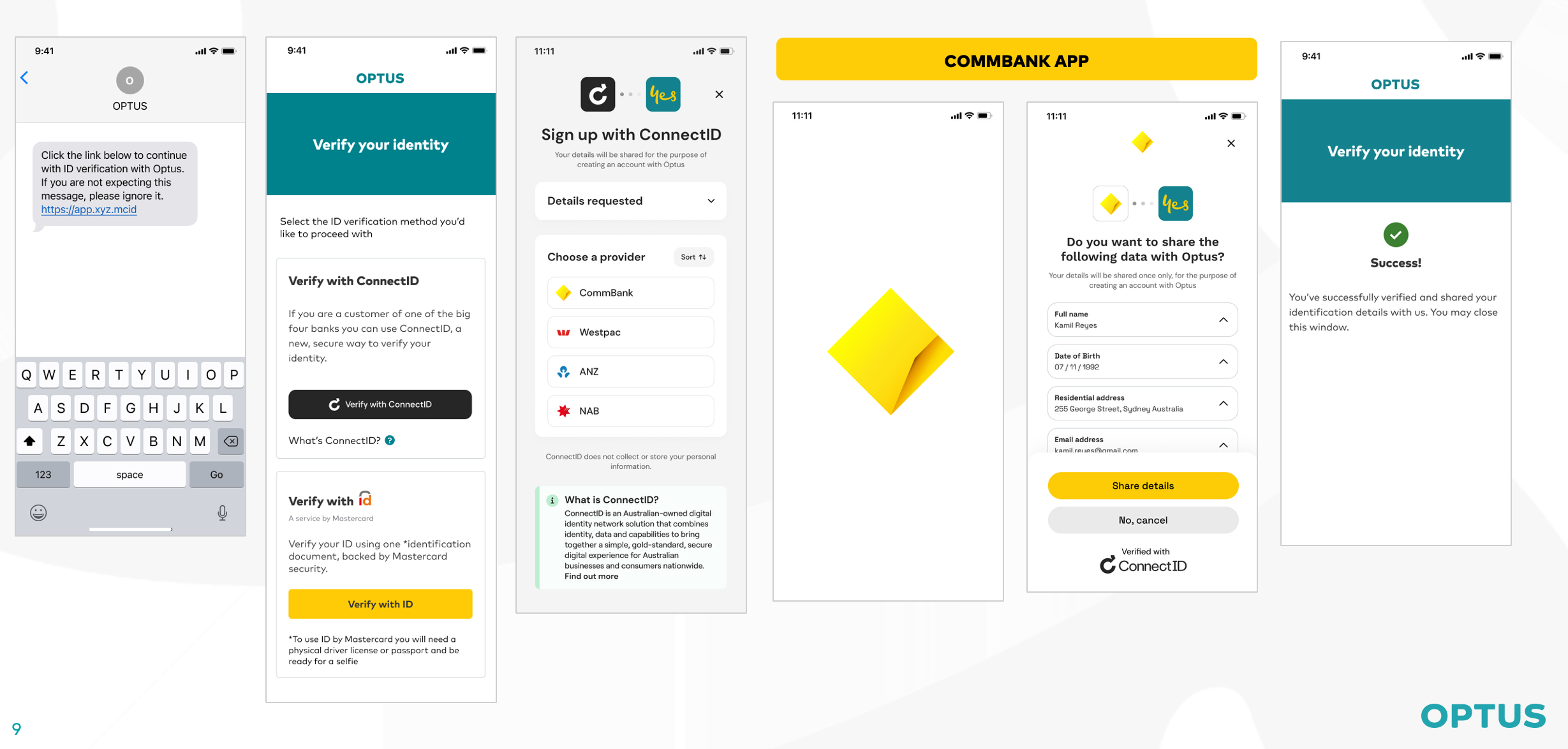

ConnectID

Another key initiative the company explored was providing customers with options for ID verification, allowing them to choose the method most convenient for them. ConnectID was considered as one of these options, and I was involved in the initial discovery phase, including running workshops with AP+ (the provider of ConnectID along with other payment solutions such as BPAY, EFTPOS, and PayID). We also conducted several workshops and research activities across both the agent and customer sides, covering multiple channels and touchpoints including retail, contact centres, and self-serve environments.